|

Press Release

Date: 13-Aug-24 PACRA Assigns Star Ranking to Faysal Islamic Asset Allocation Fund

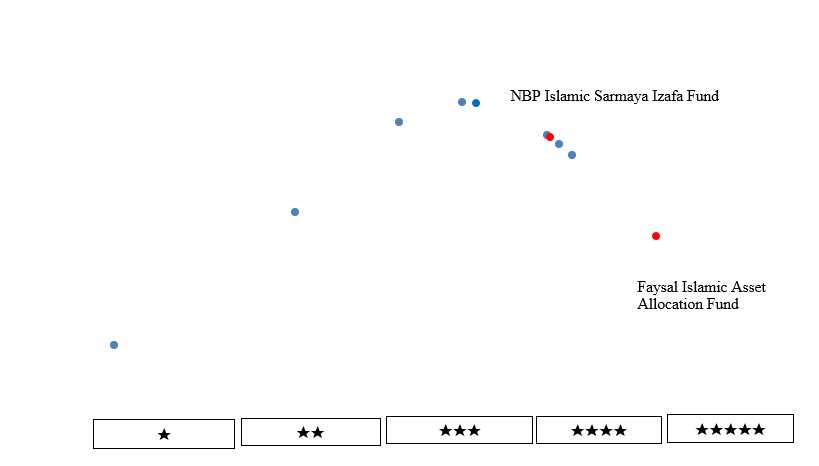

1-Year |

| Rating Details | Rating Type | Star Ranking | |

| Fund Category | Shariah-compliant Asset Allocation | ||

| Total Fund In Category | 12 | ||

| Performance Period | 1-Year | ||

| Dissemination Date | Current (13-Aug-24) | Previous (14-Feb-24) | |

| Ranking | 3-Star | 3-Star | |

| Rating Rationale |

During FY24, the KSE-100, KSE-30 index and KMI-30 improved by ~89.42%, 72.73% and ~78.69%. This notable upswing was propelled by changing macroeconomic drivers, initiated by the approval of the IMF program by mid of the year followed by the decline in policy rate, revival of foreign investment, stability in PKR: USD parity and improvement in foreign exchange reserves to reach USD 13.9bln as of Jun’24. PACRA ranked two funds among the universe of twelve funds. The category average showed a positive return of ~41.85%. While top performing fund in the category showed a return of ~80.63%. Faysal Islamic Asset Allocation Fund ranked 3 Star. The total return of Faysal Islamic Asset Allocation Fund in 1-year is ~21.97% which performed significantly low with the stock market positive return of 78.69%. At the end of Jun'24, the Fund had invested 33.72% in AAA rated avenues, 29.25% in AA+ rated avenues, 25.58% in A rated avenues, 6.73% in AA rated avenues, 1.97% in A- rated avenues, 0.13% in AA- rated avenues, 0.03% in A+ rated avenues. The Fund managed to handle the redemption pressure by maintaining sufficient liquidity in the form of cash. The Fund generated income by investing ~47.55% in Sukuk, ~29.36% Ijara Sukuk, ~20.50 in cash and ~2.6% in others. at the end of Jun'24.

|

|

| Regulatory Disclosures | Analyst | Applicable Criteria | Related Research |

| Hassaan Ahmad Hassaan.Ahmad@pacra.com +92-42-35869504 www.pacra.com |

Assessment Framework | Performance Ranking | Jul-24 |

Sector Study | Mutual Funds | Feb-24 |

| Disclaimer | This press release is being transmitted for the sole purpose of dissemination through print/electronic media. The press release may be used in full or in part without changing the meaning or context thereof with due credit to PACRA. The primary function of PACRA is to evaluate the capacity and willingness of an entity to honor its obligations. Our ratings reflect an independent, professional and impartial assessment of the risks associated with a particular instrument or an entity. PACRA opinion is not a recommendation to purchase, sell or hold a security, in as much as it does not comment on the security's market price or suitability for a particular investor. |

|

Press Release

Date: 13-Aug-24 PACRA Assigns Star Ranking to Faysal Islamic Asset Allocation Fund

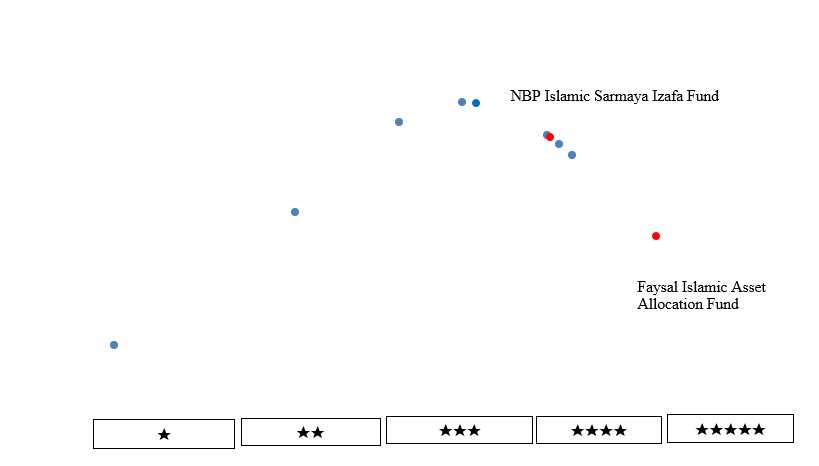

3-Year |

| Rating Details | Rating Type | Star Ranking | |

| Fund Category | Shariah-compliant Asset Allocation | ||

| Total Fund In Category | 12 | ||

| Performance Period | 3-Year | ||

| Dissemination Date | Current (13-Aug-24) | Previous (14-Feb-24) | |

| Ranking | 4-Star | 4-Star | |

| Rating Rationale |

During 3-year, the overall market faced numerous economic challenges; delays in the resumption of the IMF program, a growing fiscal deficit, elections and fluctuation in the policy rate and inflation. PACRA ranked two funds among the universe of twelve funds. The category average showed a return of ~43.40%. FY23 experienced severe distress due to political instability, however the market started too perform after 1QFY24. The top-performing fund in 3-Year of the category showed a return of ~114.76%. Faysal Islamic Asset Allocation Fund ranked 4 Star. The total return of Faysal Islamic Asset Allocation Fund in 3-year is ~54.35% which underperformed than the stock market return of 64.99%. At the end of Jun'24, the Fund had invested 33.72% in AAA rated avenues, 29.25% in AA+ rated avenues, 25.58% in A rated avenues, 6.73% in AA rated avenues, 1.97% in A- rated avenues, 0.13% in AA- rated avenues, 0.03% in A+ rated avenues. The Fund managed to handle the redemption pressure by maintaining sufficient liquidity in the form of cash. The Fund generated income by investing ~47.55% in Sukuk, ~29.36% Ijara Sukuk, ~20.50 in cash and ~2.6% in others. at the end of Jun'24.

|

|

| Regulatory Disclosures | Analyst | Applicable Criteria | Related Research |

| Hassaan Ahmad Hassaan.Ahmad@pacra.com +92-42-35869504 www.pacra.com |

Assessment Framework | Performance Ranking | Jul-24 |

Sector Study | Mutual Funds | Feb-24 |

| Disclaimer | This press release is being transmitted for the sole purpose of dissemination through print/electronic media. The press release may be used in full or in part without changing the meaning or context thereof with due credit to PACRA. The primary function of PACRA is to evaluate the capacity and willingness of an entity to honor its obligations. Our ratings reflect an independent, professional and impartial assessment of the risks associated with a particular instrument or an entity. PACRA opinion is not a recommendation to purchase, sell or hold a security, in as much as it does not comment on the security's market price or suitability for a particular investor. |

|

Press Release

Date: 13-Aug-24 PACRA Assigns Star Ranking to Faysal Islamic Asset Allocation Fund

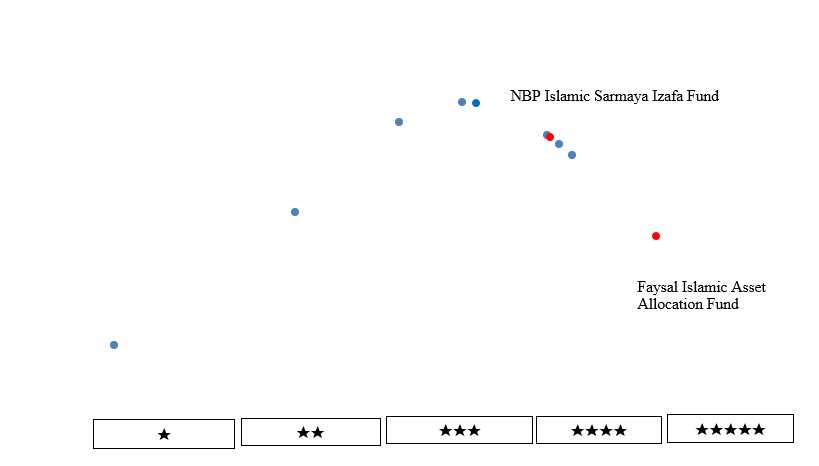

5-Year |

| Rating Details | Rating Type | Star Ranking | |

| Fund Category | Shariah-compliant Asset Allocation | ||

| Total Fund In Category | 12 | ||

| Performance Period | 5-Year | ||

| Dissemination Date | Current (13-Aug-24) | Previous (14-Feb-24) | |

| Ranking | 5-Star | 4-Star | |

| Rating Rationale |

During 5-year, the overall market faced numerous economic challenges; delays in the resumption of the IMF program, a growing fiscal deficit, elections and fluctuation in the policy rate and inflation. The year 2020 was a year of severe distress due to Covid which impacted the stock market significantly. PACRA ranked two funds among the universe of ten funds. The category average showed a return of ~68.70%. While top-performing fund in 5-Year of the category showed a return of ~104.09%. Faysal Islamic Asset Allocation Fund ranked 5 Star. The total return of Faysal Islamic Asset Allocation Fund Fund in 5-year is ~85.42% which performed significantly lower than the stock market return of 133.60%. At the end of Jun'24, the Fund had invested 33.72% in AAA rated avenues, 29.25% in AA+ rated avenues, 25.58% in A rated avenues, 6.73% in AA rated avenues, 1.97% in A- rated avenues, 0.13% in AA- rated avenues, 0.03% in A+ rated avenues. The Fund managed to handle the redemption pressure by maintaining sufficient liquidity in the form of cash. The Fund generated income by investing ~47.55% in Sukuk, ~29.36% Ijara Sukuk, ~20.50 in cash and ~2.6% in others. at the end of Jun'24.

|

|

| Regulatory Disclosures | Analyst | Applicable Criteria | Related Research |

| Hassaan Ahmad Hassaan.Ahmad@pacra.com +92-42-35869504 www.pacra.com |

Assessment Framework | Performance Ranking | Jul-24 |

Sector Study | Mutual Funds | Feb-24 |

| Disclaimer | This press release is being transmitted for the sole purpose of dissemination through print/electronic media. The press release may be used in full or in part without changing the meaning or context thereof with due credit to PACRA. The primary function of PACRA is to evaluate the capacity and willingness of an entity to honor its obligations. Our ratings reflect an independent, professional and impartial assessment of the risks associated with a particular instrument or an entity. PACRA opinion is not a recommendation to purchase, sell or hold a security, in as much as it does not comment on the security's market price or suitability for a particular investor. |